Markets Models and Methods Applied Quantitative Finance: Unveiling the Complexities of Financial Markets

The world of finance is a complex and ever-evolving landscape, characterized by intricate markets, sophisticated models, and advanced quantitative techniques. Quantitative finance, a specialized field at the intersection of finance and mathematics, has emerged as a powerful tool for understanding and navigating the complexities of financial markets. This article delves into the markets, models, and methods used in quantitative finance, providing insights into the underlying mechanisms that drive financial decision-making and risk management.

Markets in Quantitative Finance

Financial markets serve as the platform for trading various financial instruments, including stocks, bonds, currencies, and derivatives. These markets can be classified into different categories based on their structure, regulation, and products offered.

4.7 out of 5

| Language | : | English |

| File size | : | 14512 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 436 pages |

Primary Markets

Primary markets facilitate the issuance of new securities, such as stocks or bonds, to raise capital from investors. Companies seeking to raise funds issue new shares or bonds, which are then purchased by investors through investment banks or underwriting firms.

Secondary Markets

Secondary markets provide a platform for trading existing securities after they have been issued. These markets allow investors to buy and sell securities among themselves, facilitating liquidity and price discovery. Examples include stock exchanges and bond markets.

Derivatives Markets

Derivatives markets involve trading financial contracts whose value is derived from an underlying asset, such as a stock, bond, or commodity. Common types of derivatives include options, futures, and swaps, which allow investors to speculate or hedge against price fluctuations.

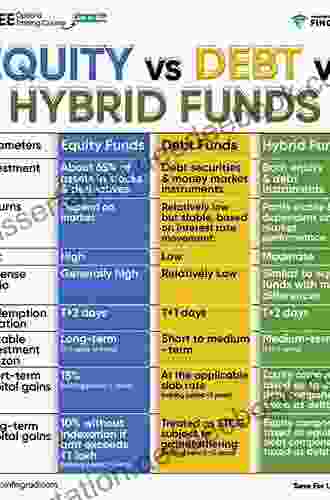

Models in Quantitative Finance

Quantitative finance employs a wide range of mathematical models to analyze financial markets and develop trading strategies. These models capture the complexities of market behavior, enabling analysts to make informed decisions.

Stochastic Models

Stochastic models incorporate randomness into their calculations, recognizing that financial markets are inherently unpredictable. They use probability distributions to simulate market behavior and quantify risk. Examples include the Black-Scholes model for option pricing and the Monte Carlo simulation for risk assessment.

Deterministic Models

Deterministic models assume that market behavior follows a predictable pattern, typically based on historical data or economic principles. They use mathematical equations to calculate optimal trading strategies and risk-adjusted returns. Examples include the CAPM (Capital Asset Pricing Model) for asset allocation and the Markowitz model for portfolio optimization.

Hybrid Models

Hybrid models combine elements of both stochastic and deterministic models, offering a more comprehensive representation of market dynamics. They capture the uncertainties of market behavior while incorporating insights from economic theory.

Methods in Quantitative Finance

Quantitative finance utilizes a range of methods to analyze data, develop models, and make trading decisions. These methods leverage computational power and advanced statistical techniques.

Statistical Analysis

Statistical analysis involves collecting, analyzing, and interpreting financial data to identify patterns, trends, and relationships. It helps in risk assessment, portfolio optimization, and forecasting market behavior.

Econometrics

Econometrics combines economic theory with statistical methods to estimate and test economic relationships. It allows analysts to model the behavior of financial markets and forecast future outcomes based on macroeconomic factors.

Machine Learning

Machine learning algorithms enable computers to learn from historical data and make predictions. They are used for tasks such as stock price forecasting, fraud detection, and portfolio optimization.

High-Frequency Trading

High-frequency trading involves executing trades at very short intervals, often using algorithmic trading strategies. It leverages high-frequency data and advanced statistical techniques to capture market inefficiencies and generate profits.

Applications of Quantitative Finance

Quantitative finance has numerous applications in the financial sector, including:

Risk Management

Quantitative models help in identifying, measuring, and managing risks associated with financial investments. They enable risk managers to assess potential losses and develop strategies to mitigate risks.

Portfolio Optimization

Quantitative methods assist in constructing optimal portfolios that balance risk and return based on an investor's risk tolerance and financial goals.

Trading Strategies

Quantitative models and methods are used to develop trading strategies that exploit market inefficiencies, forecast price movements, and generate alpha.

Financial Engineering

Quantitative finance plays a crucial role in the design and development of financial products, such as structured finance instruments and derivatives.

Quantitative finance is a complex and fascinating field that provides a powerful toolkit for understanding and navigating financial markets. With its sophisticated models and advanced methods, quantitative finance empowers analysts, traders, and investors to make informed decisions, manage risks, and optimize their financial outcomes. As the financial world continues to evolve, quantitative finance will undoubtedly play an increasingly vital role in shaping the future of finance.

4.7 out of 5

| Language | : | English |

| File size | : | 14512 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 436 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Story

Story Genre

Genre Library

Library Paperback

Paperback Magazine

Magazine Newspaper

Newspaper Sentence

Sentence Bookmark

Bookmark Glossary

Glossary Bibliography

Bibliography Preface

Preface Annotation

Annotation Manuscript

Manuscript Scroll

Scroll Codex

Codex Bestseller

Bestseller Classics

Classics Biography

Biography Dictionary

Dictionary Character

Character Resolution

Resolution Librarian

Librarian Borrowing

Borrowing Periodicals

Periodicals Scholarly

Scholarly Lending

Lending Reserve

Reserve Academic

Academic Special Collections

Special Collections Study Group

Study Group Thesis

Thesis Awards

Awards Reading List

Reading List Book Club

Book Club Theory

Theory Textbooks

Textbooks Dave Kilgore

Dave Kilgore Matthew Burgess

Matthew Burgess Jackie Barbosa

Jackie Barbosa Randell Alexander

Randell Alexander Quintus Curtius

Quintus Curtius Alejandro L Madrid

Alejandro L Madrid Richard D Mahoney

Richard D Mahoney K Nicole

K Nicole Nick Thorpe

Nick Thorpe Sidney Hook

Sidney Hook Paul Read

Paul Read Joann Klusmeyer

Joann Klusmeyer Rebecca Setler

Rebecca Setler Raymond Carver

Raymond Carver Valerie Francisco Menchavez

Valerie Francisco Menchavez Donna Walker Tileston

Donna Walker Tileston Andrew Shennan

Andrew Shennan Paula Paul

Paula Paul Bryan Bruce

Bryan Bruce 3rd Edition Kindle Edition

3rd Edition Kindle Edition

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Noah BlairFollow ·5.7k

Noah BlairFollow ·5.7k Cody RussellFollow ·15.9k

Cody RussellFollow ·15.9k Hugh BellFollow ·5.6k

Hugh BellFollow ·5.6k Dalton FosterFollow ·19.2k

Dalton FosterFollow ·19.2k Ira CoxFollow ·5.4k

Ira CoxFollow ·5.4k Graham BlairFollow ·8.5k

Graham BlairFollow ·8.5k Stuart BlairFollow ·14k

Stuart BlairFollow ·14k Jacques BellFollow ·17.3k

Jacques BellFollow ·17.3k

Keith Cox

Keith CoxFrench Pieces for Flute and Piano: A Journey into...

The world of...

Justin Bell

Justin BellThe Big Clarinet Songbook: A Musical Treasure for...

The clarinet, with its rich...

Jamie Blair

Jamie BlairThe Metamorphoses of Ovid: A Masterpiece of...

An Epic Tapestry of Mythology and...

Alan Turner

Alan TurnerBaa Baa Black Sheep: A Classic Sing-Along Song for Kids

Baa Baa Black Sheep...

Bradley Dixon

Bradley DixonUnveiling the Enigmatic Shakespeare Spy: The...

Prologue: The Shadowy World...

Gilbert Cox

Gilbert CoxUnleash Your Creativity with Plastic Craft Lace Projects:...

Plastic craft lace is a...

4.7 out of 5

| Language | : | English |

| File size | : | 14512 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 436 pages |