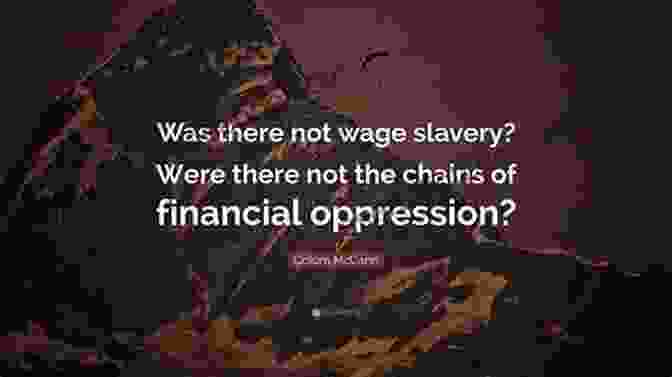

The Vampire Debt: Shadow World of Financial Oppression

In the twilight realm where shadows dance and secrets lurk, there exists a sinister force that feeds upon the very lifeblood of its victims—the Vampire Debt. This insidious entity has cast its oppressive grip over countless individuals, plunging them into a perpetual state of financial servitude. Like a vampire that drains its prey of blood, the Vampire Debt relentlessly siphons away wealth, dreams, and futures.

The Genesis of the Vampire Debt

The Vampire Debt's origins can be traced back to the murky waters of predatory lending practices. Unconscionable interest rates, hidden fees, and balloon payments have ensnared countless borrowers, entrapping them in a cycle of perpetual indebtedness. Subprime mortgages, payday loans, and credit card debt have become the fangs of this financial predator.

4.3 out of 5

| Language | : | English |

| File size | : | 2615 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 200 pages |

| Lending | : | Enabled |

Predatory lenders often target vulnerable individuals, those who are desperate for quick cash or who lack financial literacy. With siren calls of easy money and low initial payments, they lure unsuspecting victims into a trap that will haunt them for years to come.

The Symptoms of the Vampire Debt

The Vampire Debt manifests itself in a myriad of insidious ways. Its victims may experience:

* Crushing monthly payments: The burden of astronomical interest rates and hidden fees can consume a significant portion of borrowers' income, leaving them with little to cover basic necessities. * Declining credit scores: Missed or late payments due to overwhelming debt can severely damage credit scores, making it more difficult to obtain affordable loans in the future. * Wage garnishment: In extreme cases, creditors can obtain court orders to garnish wages, seizing a portion of borrowers' hard-earned income to satisfy their debts. * Emotional distress: The constant weight of debt can take a heavy toll on mental health, leading to anxiety, depression, and even suicidal thoughts.

The Shadow World of the Vampire Debt

The Vampire Debt operates in a shadowy realm where few dare to venture. Debt collectors employ aggressive tactics, often resorting to threats, harassment, and intimidation to extract payments. They prey upon the fear and desperation of their victims, exploiting their vulnerabilities to maintain their financial grip.

The Vampire Debt industry has grown into a multi-billion-dollar enterprise, with countless individuals and companies profiting from the misery of others. Collection agencies, debt buyers, and predatory lenders have created a complex web of financial exploitation that ensnares millions every year.

Breaking Free from the Vampire Debt

Breaking free from the clutches of the Vampire Debt is a daunting task, but it is possible. Here are some strategies to consider:

* Credit counseling: Nonprofit credit counseling agencies can provide guidance, support, and debt management plans to help individuals reduce their debt and improve their financial situation. * Debt consolidation: Consolidating multiple debts into a single loan with a lower interest rate can reduce monthly payments and simplify the repayment process. * Debt settlement: In some cases, it may be possible to negotiate a settlement with creditors for less than the full amount owed. However, this can have negative consequences for credit scores. * Bankruptcy: As a last resort, individuals who are overwhelmed by debt may consider filing for bankruptcy. This can provide a fresh start by discharging certain debts, but it can also have long-term consequences.

The Role of Government and Regulation

Governments worldwide have a responsibility to protect citizens from the predatory practices of the Vampire Debt industry. Stronger regulations are needed to stem the tide of predatory lending and ensure that borrowers are treated fairly. Measures such as interest rate caps, limits on fees, and stricter lending standards can help prevent individuals from falling prey to predatory lenders.

Government-backed programs can also provide assistance to those struggling with debt, such as low-interest loans, financial counseling, and housing assistance. By addressing the systemic issues that contribute to the Vampire Debt, we can create a more just and equitable financial system.

The Vampire Debt is a blight upon our society, a financial shadow that casts a long and oppressive gloom over countless lives. Its insidious nature preys upon the vulnerable, ensnaring them in a cycle of perpetual indebtedness. However, by understanding the tactics of the Vampire Debt and seeking help from reputable sources, victims can break free from its clutches and reclaim their financial freedom. Governments must play a vital role in regulating the financial industry and protecting citizens from predatory practices that perpetuate the Vampire Debt. Only by casting light upon this Shadow World can we truly combat the horrors that it inflicts upon our society.

4.3 out of 5

| Language | : | English |

| File size | : | 2615 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 200 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Genre

Genre Reader

Reader Library

Library E-book

E-book Paragraph

Paragraph Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Preface

Preface Synopsis

Synopsis Manuscript

Manuscript Codex

Codex Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Dictionary

Dictionary Thesaurus

Thesaurus Narrator

Narrator Card Catalog

Card Catalog Borrowing

Borrowing Stacks

Stacks Study

Study Research

Research Scholarly

Scholarly Journals

Journals Rare Books

Rare Books Interlibrary

Interlibrary Literacy

Literacy Dissertation

Dissertation Storytelling

Storytelling Awards

Awards Book Club

Book Club Textbooks

Textbooks Steven W Bender

Steven W Bender Robert Moriarty

Robert Moriarty Renhui

Renhui 3rd Edition Kindle Edition

3rd Edition Kindle Edition Robert G Mccloskey

Robert G Mccloskey Liane Carter

Liane Carter Linda Hymes

Linda Hymes Paul Krugman

Paul Krugman Mike Loades

Mike Loades David Greig

David Greig Lee Everett

Lee Everett Simon Akam

Simon Akam Ali Winters

Ali Winters Alexandra Gruber

Alexandra Gruber Pascaliah Omiya

Pascaliah Omiya Beautiful World Escapes

Beautiful World Escapes Percy Rossell Perry

Percy Rossell Perry Christina Shelton

Christina Shelton Ruby Lorraine Radford

Ruby Lorraine Radford Betty White

Betty White

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Donald WardFollow ·13.3k

Donald WardFollow ·13.3k Ralph Waldo EmersonFollow ·12.4k

Ralph Waldo EmersonFollow ·12.4k Christopher WoodsFollow ·12k

Christopher WoodsFollow ·12k Preston SimmonsFollow ·16.8k

Preston SimmonsFollow ·16.8k Chuck MitchellFollow ·19.2k

Chuck MitchellFollow ·19.2k Dwight BellFollow ·8.4k

Dwight BellFollow ·8.4k DeShawn PowellFollow ·5.3k

DeShawn PowellFollow ·5.3k Ben HayesFollow ·12.1k

Ben HayesFollow ·12.1k

Keith Cox

Keith CoxFrench Pieces for Flute and Piano: A Journey into...

The world of...

Justin Bell

Justin BellThe Big Clarinet Songbook: A Musical Treasure for...

The clarinet, with its rich...

Jamie Blair

Jamie BlairThe Metamorphoses of Ovid: A Masterpiece of...

An Epic Tapestry of Mythology and...

Alan Turner

Alan TurnerBaa Baa Black Sheep: A Classic Sing-Along Song for Kids

Baa Baa Black Sheep...

Bradley Dixon

Bradley DixonUnveiling the Enigmatic Shakespeare Spy: The...

Prologue: The Shadowy World...

Gilbert Cox

Gilbert CoxUnleash Your Creativity with Plastic Craft Lace Projects:...

Plastic craft lace is a...

4.3 out of 5

| Language | : | English |

| File size | : | 2615 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 200 pages |

| Lending | : | Enabled |